Position Sizing and Stop Losses

The 2% Rule

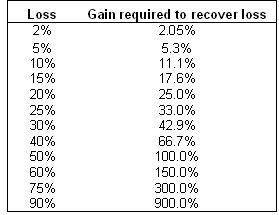

The 2% rule is mentioned by a lot of stock trading authors such as Alexander Elder, Darryl Guppy and Van Tharp. In his book Trade Your Way to Financial Freedom Van Tharp stresses the importance of the 2% rule and position sizing. Position sizing is not as simple as just buying stock in round number lots of 100, or dividing your total capital available by the ask price. Position sizing requires calculation of a viable stop loss point on the stocks chart and adjusting the size of the position so as to not lose any more than 2% of your capital if the stock falls to that price. Why 2%? Take a look at the graph below to see the gain required after a loss, just to get back to breakeven:

As you can see, the gain required increases exponentially until the required gain is so big it is either no longer viable, or the trader is wiped out.

The other reason 2% is important is when considering a losing streak. I can speak from personal experience these do happen L. If a trader allowed his loss to increase to 50%, he will be left with only half his capital. Another loss of the same percentage and he is now down to just 25% of his original capital. If you started with $10,000.00 and after just two trades you only had $2,500.00 left, you would be pretty unhappy. Your next trade would have to make a 300% profit for you to breakeven to your original amount, and this does not happen very often.

On the other hand if you had the same $10,000.00, applied the 2% rule, set a stop loss (SL) and sold out for a loss of just $200.00 you would still have $9,800.00 left in your account. If you have a second loss of $196.00, you will still have $9604.00. Even after a third 2% loss of $192.08, you would still have $9411.02. To break even now after three losing trades, you only require a 6.25% profit to get back to $10,000.00. Even after a really bad losing streak of ten losses in a row, at 2% each you will still be left with $8170.72. It may take a few wins to gain back the 22.4%, but at least you are still in the game.

Position Sizing

So how then do you apply this to position sizing? First off calculate the expected buy price. It is important to buy as close to the breakout point as possible, preferably at the breakout point + 10 cents. Next, look for a stop loss point just below this price, preferably just below an area of support. Calculate the difference between the two prices and divide 2% of your available capital by this amount. For example:

(Click to enlarge)

(Click to enlarge)

On the chart above, using a buy price of $45.60 (10 cents above the breakout point of $45.50) and a SL price of $44.90 (10 cents below support at $45.00), the difference is $0.60. If our account has $10,000.00 in it, 2% of this is $200.00. We divide $200.00 by $0.60 = 333.3. Now if we bought a maximum of 333 shares at $45.60, the price then falls and we get stopped out at $44.90, we will only lose $199.80. If we ignored the 2% rule and bought 500 shares, we would be stopped out with a loss of $300.00 or 3%.

Automatic stop loss orders

Automatic stop loss (SL) orders are the savior for the not so disciplined. It is one thing to use a mental SL point and say ‘if the price drops to this point I will sell’, but another to actually go through with it. It takes great discipline to actually sell the stock when it hits the SL point. The common emotion a trader feels when his trade is showing a paper loss is one of hope. Hope that the stock will rebound to the initial buy point. When the price drops to their mental SL point, the trader says ‘no, I will choose to not sell now and wait and see if the stock will bounce back. If so, I will not need to sell and make a loss, but if it drops any further, then I promise myself I will sell’. Inevitably the stock drops further and the trader still doesn’t sell, but says ‘when the stock rebounds to my initial SL point, then I promise this time I will sell’. Of course, the market has other ideas. The stock drops further and the trader’s loss has increased substantially with less and less hope of the wanted rebound. Eventually the trader gives in and sells the stock at a huge loss, or worse still, converts the ‘trade’ into an ‘investment’ for the long term because eventually it might rebound – hopefully. Remember from above, the bigger the loss, the exponentially greater gain required to breakeven.

It won’t happen to me, you say? I am disciplined enough to make sure I do sell at my SL point. I consider myself to be well self disciplined, but when your money is on the table, the temptation to not sell immediately can be overwhelming. The best solution to ensure you do sell at your nominated SL point is to set an automatic SL order with your broker. This will ensure you are stopped out at, or near to, your nominated price. It is always hard to take a small loss, or even a series of them, but it is even harder to take an even bigger loss.

Another justification traders use for applying mental SL points is to protect them rather than automatic SLs, is the professionals who aim to trigger the obvious SL points before reversing the market and sending it the other way. The solution to this? Don’t set your SL order at an obvious price. In the example above the obvious point is $45.00. Instead of setting the SL there, I have chosen to put it just below at $44.90. This way the stock has to trade down through the round figure of $45.00 by another 10 cents before triggering the SL. The SL point might be further away but it is better than being whipsawed out to soon.

Price Targets

Even better than being stopped out is to sell the shares at a profit. This is where setting price targets come in. In the example above the price target is set by subtracting the low of $36.00 from the high at $45.50 = $15.50. Then halve this ($7.25) and add it to $45.50 = $52.75. To read more about setting price targets, please see my article on Chart Patterns and Breakouts.

In this example the potential profit at our price target is approximately 12 times the size of our potential loss at our SL point – which is great. If we purchased 333 shares, our profit if we sell at $52.75 will be $2414.25 (disregarding brokerage fees).

If our price target was only $46.00, then our potential profit is only $133.20, which is only two-thirds our 2% risked. At this price target the trade is not viable and should be disregarded, and another opportunity be sought.

For more information regarding the 2% rule, stop losses, and position sizing, I thoroughly recommend reading Van Tharp’s book

Next Article

*Please leave any comments you may have at Reeholio Stock Market Trading Home Page